RMS

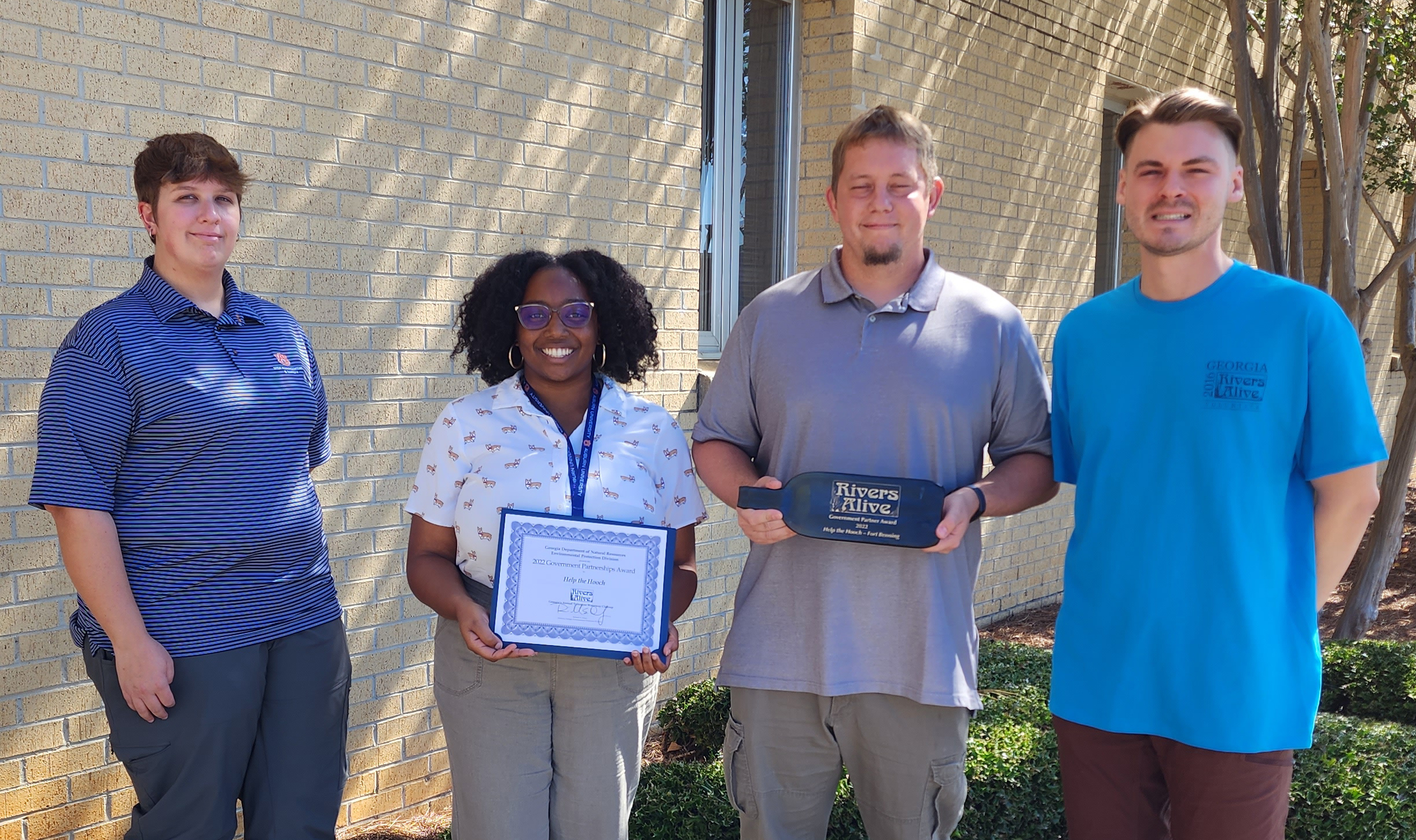

Conservation and Cleanup Efforts of Auburn Staff Win Government Partner Award

5/1/2023

The conservation and volunteer efforts of Auburn University employees continue to earn major recognition.

The Help the Hooch Cleanup was chosen by Rivers Alive as the 2022 Government Partner Award winner. The award was presented to the Ft. Benning Department of Public Works (DPW) Environmental Programs and Auburn University Intergovernmental Service Agreement (IGSA) Clean Water Team at the Rivers Alive awards ceremony and luncheon on Thursday, April 27th in Atlanta. Team Members Erin Perry (NPDES Compliance Technician), Jasmine Truitt (NPDES Compliance Specialist), Anthony Harrington (GIS Specialist), and Jack Hovey (NPDES Compliance Specialist), were recognized (Pictured Above L-R).

The Help the Hooch event was held on October 14, 2022, and began at the Uchee Creek Marina. The cleanup event was open to soldiers, families, and partner organizations and helped to remove an estimated 130 bags of trash, 31 tires, and about 500 pounds of metal. The most common items included plastic bottles, aluminum cans, and fishing supplies.

The Help the Hooch is an integral conservation event to help maintain a key portion of the Chattahoochee River. The river is home to over 20 species of freshwater turtles, nine threatened and endangered species, and one of only two trout streams that flow through a major urban area.

Auburn University faculty, staff, and students are encouraged to participate in the 2023 Help the Hooch cleanup event. Information about the 2023 event including registration information and dates will be advertised on campus and AU News.

Risk Management and Safety Announces Winter Holiday Waste Service Protocol

11/29/2021

Both chemical and medical waste pickups will be temporarily suspended throughout the Auburn University recognized holiday period. Any chemical and/or medical waste generated during the holiday break should be properly containerized, labeled, and stored per guidelines found on the RMS/EHS webpage www.auburn.edu/administration/rms/environmental.html .

Chemical and medical waste pickups will resume on January 3, 2022, on an as-requested basis.

Pathological waste pickup service will be provided throughout the holiday period on an as-needed and as-requested basis. Pickup requests shall be submitted through the AiM work management system (https://aim.auburn.edu/aim ).

Advance notice shall be coordinated with primary contact Steven Nolen (334-703-3859) or secondary contact Billy Cannon (334-703-0419), to ensure the timely removal of pathological waste from your areas during this period.

If you anticipate your areas needing servicing over the observed holiday break, please contact me Tom McCauley, Environmental Health & Safety Program Manager at 334-844-4870 so that RMS may coordinate in advance as best we can to accommodate your needs.

Guide on Purchasing DEA Scheduled and Listed Substances

8/6/2020

Controlled Substances

-

Controlled substances are drugs or other substances, or immediate precursors, listed under schedules I-V of the Controlled Substance Act (21 USC §812) (CSA). Schedules are assigned based on pharmacological effect, potential for abuse and dependency, and medical use. Current scheduling can be found in section 1308 of Title 21 Code of Federal Regulations (21 CFR §§1308.11-1308.15).

-

Procurement, storage, security, use and disposal of controlled substances is strictly regulated by the federal Drug Enforcement Agency (DEA). Research involving the use of controlled substances requires DEA registration and licensing. DEA licenses are specific to each PI, and the PI holding a DEA license is responsible for observing and implementing DEA regulations (annual registration renewal, inventory and record keeping, storage and security requirements, inspection preparedness, proper disposal etc.)

-

Purchase of schedule I and II controlled substances requires completion of Form 222 (21 CFR §§1305.11-1305.20). All relevant forms can be found here.

DEA Listed Chemicals

-

DEA Listed Chemicals are chemicals important as precursors in the manufacture of controlled substances and listed in the CSA under the Chemical Diversion and Trafficking Act of 1988. Listed Chemicals can be found in Title 21 Code of Federal Regulations (CFR) §1310.02 (Table of Listed Chemicals).

-

While a DEA license is not required to purchase DEA listed chemicals, vendors may request additional information before ordering. VWR, Auburn University’s preferred vendor, requires submission of Intended Use Declaration of DEA List 1 Chemicals Form before ordering.

Please contact RMS at 334 844 4870 if you have any questions.

Create Work From Home Success with Office Ergonomics Awareness

3/23/2020

To help aide in social distancing and alternate operations at Auburn University, many faculty, staff, and students are now working and studying at home. To help support success, Risk Management and Safety has developed a short Office Ergonomics Awareness Course. This course will help you recognize potential hazards and stressors that may impact your health, productivity, and ability. This course will also give you tips, tricks, and prevention strategies to help make working from home as comfortable, productive, and rewarding as possible. The Office Ergonomics Awareness Course is available by visiting https://aub.ie/ergonomics. For more information or questions, please email aurms@auburn.edu or call 334-844-4870.

2019 Winter Holiday Waste (chemical, medical and pathological) Service Protocol

12/11/2019

In anticipation of this year’s winter holiday break, please note and communicate to your areas the following protocol:

Both chemical and medical waste pickups will be temporarily suspended throughout the AU recognized holiday period. Any chemical and/or medical waste generated during the holiday break should be properly containerized, labeled and stored per guidelines found on the RMS/EHS webpage https://cws.auburn.edu/rms/pm/wastemanagement . Chemical and medical waste pickups will resume January 6, 2020 on an as requested basis.

Pathological waste pickup service will be provided throughout the holiday period on an as needed as requested basis. Pickup requests shall be submitted through the AiM work management system (https://aim.auburn.edu/aim). Preferably and if possible, advance notice shall be coordinated with Steven Nolen (334-703-3859) as the primary contact and Billy Cannon (334-703-0419) as the secondary contact to ensure the timely removal of pathological waste from your areas during this period.

If you anticipate your areas needing servicing over the observed holiday break, please contact Tom McCauley, Environmental Programs Manager, at 334-844-4870 so that Risk Management and Safety may coordinate in advance to better accommodate your needs.

Risk Management and Safety warns against use of Methylene Chloride Paint Remover

12/5/2019

On November 22, 2019, the Environmental Protection Agency (EPA) issued regulations on the consumer use of methylene chloride paint removers. The methylene chloride chemical was commonly found in many popular solvent-based strippers/removers due to the effectiveness. Paint removers containing methylene chloride could strip up to 15 layers in paint in as a little as 15 to 30 minutes.

It is now unlawful for any person or retailer to sell or distribute paint removal products containing methylene chloride. This includes e-commerce retailers such as Amazon or E-Bay. These EPA regulations prohibit the manufacture, import, processing, and distribution of these products. The EPA has taken action because of acute fatalities that have resulted from exposure to the chemical. Additional information on the risks associated with methylene chloride can be found here: https://www.epa.gov/assessing-and-managing-chemicals-under-tsca/risk-management-methylene-chloride .

Most retailers phased out the selling and distribution of affected products by the end of 2018. This includes Ace Hardware, Amazon, Walmart, Lowes, Home Depot, and Sherwin-Williams. However, many consumers may have purchased affected paint removers. Because of this, Auburn University Risk Management and Safety recommends reviewing any solvent-based paint removers/strippers you may have in your home or workspace. If you have any of these products, do not use them and ensure their containers are sealed and puncture free.

If you are in possession of any methylene chloride based solvents on campus, please contact Risk Management and Safety at 334-844-4870 or aurms@auburn.edu

If you are in possession of any methylene chloride based solvents in your home, please contact your city or community’s environmental services office.

Building surveys to be conducted the week of October 21st, 2019

10/17/2019

Risk Management & Safety will be working with Duff and Phelps, LLC to survey properties insured by the State Insurance Fund. Representatives will be on campus from October 21st, 2019 – October 25th, 2019 to assess current condition and valuation of select buildings. You may notice the surveyors entering mechanical rooms, electrical closets, and other restricted areas; however, they will be accompanied by AU Facilities Management. Every effort will be made to schedule surveys at times that are convenient for building occupants.

Questions or concerns may be directed to Risk Management & Safety at 844-4533.

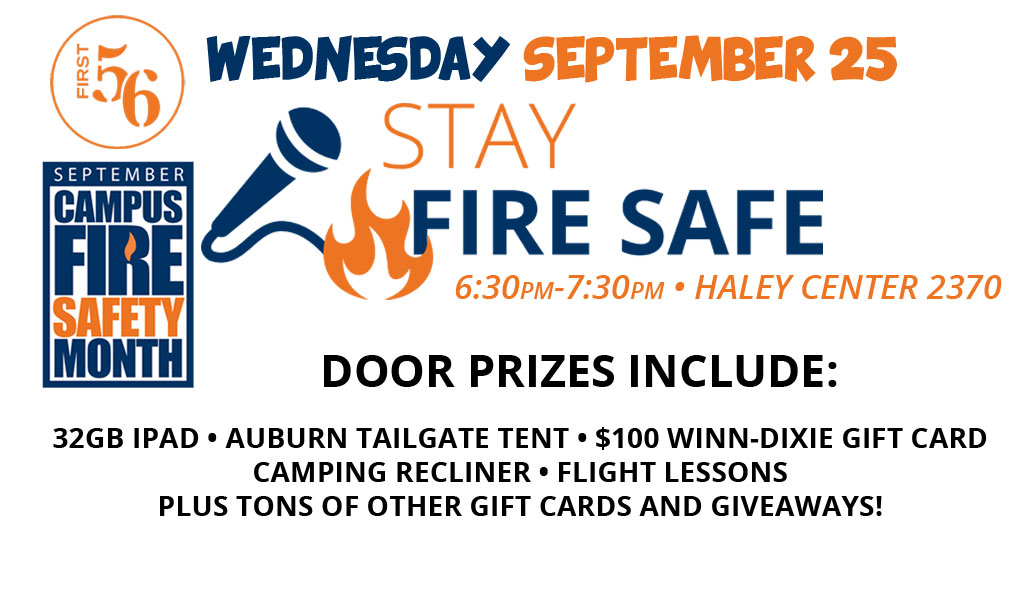

Stay Fire Safe

9/18/2019

Join Auburn University Risk Management and Safety for "Stay Fire Safe", an interactive fire safety training presentation. This event will show how to use a fire extinguisher, cooking safety tips, pet fire safety tips, and more. Plus, as an added bonus there will be door prizes including an iPad, Auburn Tailgate Tent, Gift Cards, and more! Everyone who attends will get either a Risk Management and Safety Microwave Pinch Mitt or a Fire Extinguisher Stree Reliever. Join us in Haley Room 2370 from 6:30pm until 7:30pm on Wednesday September 25th

Laser Safety Awareness Day

9/9/2019

Auburn University Risk Management and Safety (RMS) Department will be hosting Campus Laser Safety Awareness Event on October 16th, 2019 from 11 am to 2 pm at the back parking lot of Broun Hall and Woltosz. Auburn University professors and their laser users are all invited. Through this campus event, we hope to build awareness around laser safety and provide an opportunity for laser users to deepen their understanding of laser safety as laser use and application diversifies on campus.

This year we will be hosting Kentek, one of the leading companies on laser safety products. Kentek will bring the company’s laser safety expertise and educational capabilities to AU campus. Kentek’s PHOTON1 van will be filled with an interactive display of all of laser safety products. Kentek Laser safety specialist will demonstrate their products and answer some questions. This will be a unique "hands-on" learning experience for AU laser users and students.

Please save the day on October 16th for 2019 for Campus Laser Safety Awareness Event and come join us to support the event and encourage your students to be part of this educational platform.

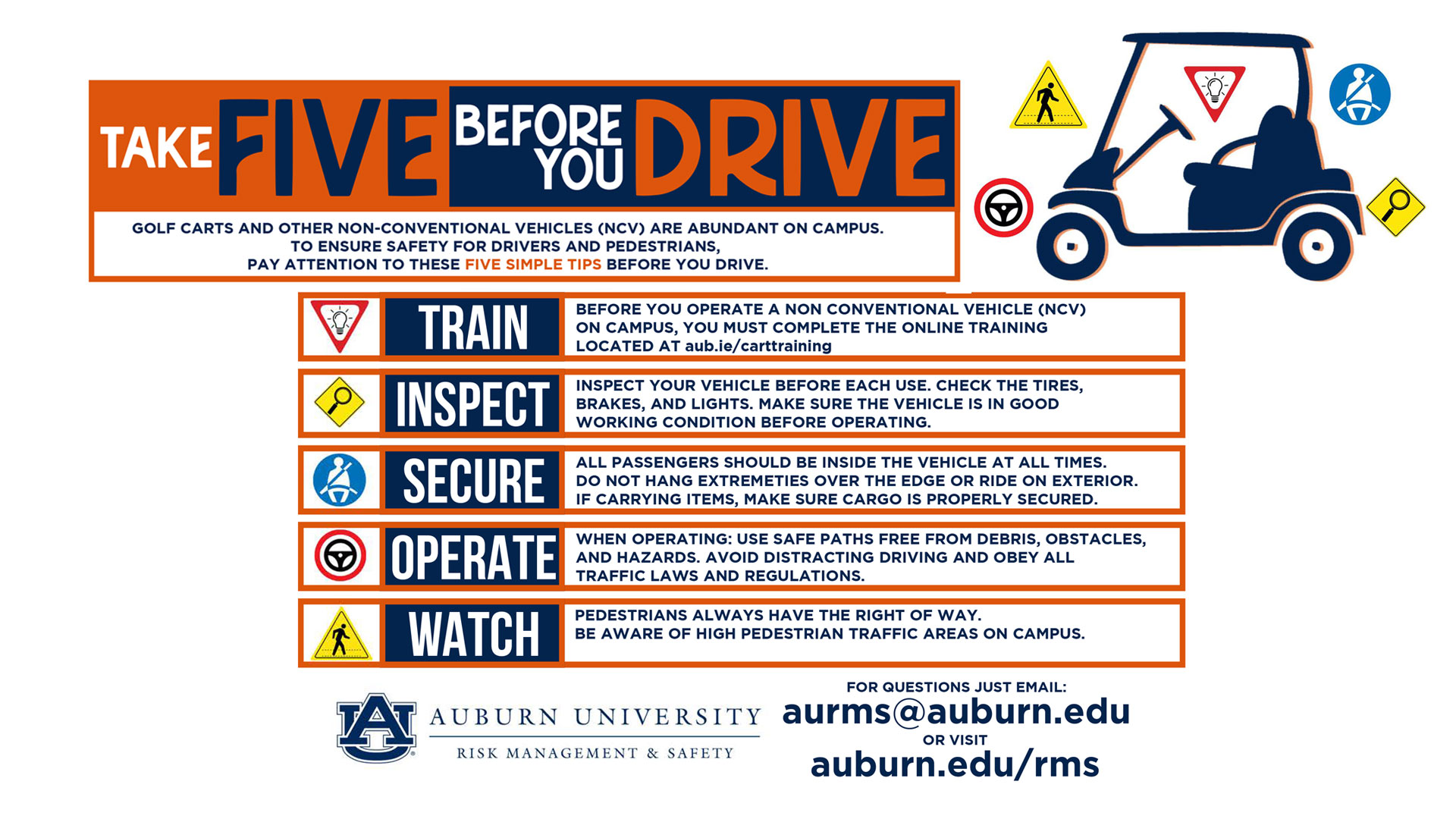

Auburn Risk Management and Safety Reminds You to “TAKE FIVE” Before You Drive

9/9/2019

Golf Carts and other non-conventional vehicles (NCV) are abundant on campus. To ensure the safety of drivers and pedestrians, Risk Management and Safety asks you to “TAKE FIVE” before you drive and pay attention to these five simple steps before operating an NCV on campus.

TRAIN – Before you operate an NCV on campus, you must complete the online training located at http://aub.ie/carttraining

INSPECT – Check the NCV before use and inspect it thoroughly. Pay specific attention to the tires, lights, and brakes, and make sure the NCV is in good working condition.

SECURE – Passengers should always be inside the vehicle. Do not hang arms, legs, or feet over the edge of the LCV and outside. Only ride or sit in a designated space, and never on top or the hood of an LCV. When carrying items, make sure cargo is properly secured in the LCV.

OPERATE – When operating an LCV, use safe paths that are free some debris, obstacles, and hazards. Avoid distracted driving and refrain from using you cell phone or electronic device while driving. As with all vehicles, you must obey all traffic laws and regulations.

WATCH – Remember that pedestrians will always have the right of way. Be aware of some higher pedestrian areas on campus such as the Haley Concourse. Plan extra travel time if using these areas and prepare for congestion.

To help encourage these safe driving habits, RMS has developed an informative graphic located at http://aub.ie/take5 . For questions, please email aurms@auburn.edu or visit auburn.edu/rms

Recycling: It's a Team Effort

9/3/2019

The work of Risk Management and Safety was recently highlighted in a post on the Office of Sustainability's Blog:

Learn more about how RMS and the battery recycling program is making a difference on campus but reading the full artilce by Hollie Lee here.

August 20th Lab Safety Training

8/2/2019

Auburn University Risk Management and Safety will hold two Lab Safety Training Sessions: August 20th from 10:30am until 11:30 am and August 28th from 3:00pm until 4:30pm. Both sessions will be held in room 109 of the CASIC Building (570 Devall Drive).

The Lab Safety Training Sessions will cover basic lab safety, biological Safety and hazardous waste management.

Auburn University Risk Management and Safety encourages all visiting summer researchers who will be working in labs to attend either of the training sessions.

RMS150: Social Media Safety and Security

6/5/2019

Join Risk Management and Safety on June 26 at 2:30pm for “Social Media Safety and Security”

Learn why companies want your personal information and why even non-identifiable information needs to be protected.

The social media landscape is ever changing and there’s an increased focused on privacy. Know what privacy changes are in store for your favorite apps and why protecting your personal information is more important than ever before.

Discover tips and tricks to protect your information. From using Virtual Private Networks to simple adjustments to your browser settings.

HRD Course RM150 will be held on June 26th from 2:30 pm until 4:30 pm in HRD Training Room 1204A. For more information, email aurms@auburn.edu

Lab Safety Training

5/13/2019

.jpg)

Auburn University Risk Management and Safety will hold Lab Safety Training Sessions on Friday, May 17th in room 109 of the CASIC Building (570 Devall Drive). In order to accommodate as many participants as possible, these Lab Safety Training Sessions will be offered at two separate times: 10:00am and 3:00pm. Both sessions are scheduled to last 90 minutes.

The Lab Safety Training Sessions will cover basic lab safety, biological Safety and hazardous waste management.

Auburn University Risk Management and Safety encourages all visiting summer researchers who will be working in labs to attend either of the training sessions.

RMS offering Lab Safety Training on May 17th

5/13/2019

Auburn University Risk Management and Safety will hold Lab Safety Training Sessions on Friday, May 17th in room 109 of the CASIC Building (570 Devall Drive). In order to accommodate as many participants as possible, these Lab Safety Training Sessions will be offered at two separate times: 10:00am and 3:00pm. Both sessions are scheduled to last 90 minutes.

The Lab Safety Training Sessions will cover basic lab safety, biological Safety and hazardous waste management.

Auburn University Risk Management and Safety encourages all visiting summer researchers who will be working in labs to attend either of the training sessions.

.jpg)

Risk Management and Safety Announces Change of Third Party Administrator Handling On-the-Job-Injury, General Liability, Auto Liability, and Auto Property Damage Claims

5/1/2019

Effective May 1, 2019 Brentwood Services Administrators will assume the role of Third-Party Administrator for Auburn University. Brentwood Services Administrators will handle administration for all new and existing On-the-Job-Injury, General Liability, Auto Liability, and Auto Property Damage claims for Auburn University. Claims or incidents can be reported through the incident entry portal at https://cws.auburn.edu/rms/pm/claims. After hours emergency claims can be reported directly to Brentwood Services Administrators at (800) 524-0604. If you should have questions regarding the transition, please contact Risk Management and Safety at (334) 844-4533.

Annual Vehicle Fire Extinguisher Inspection

4/16/2019

On Wednesday April 24th, Auburn University Risk Management and Safety will hold their annual Vehicle Fire Extinguisher Inspection from 12pm until 4pm at the Facilities Vehicle Servicing Area. This event serves as an easy and convenient opportunity to have all University Fleet vehicles equipped with a Fire Extinguisher to have their existing units checked, tested, or even replaced.

The process is simple, and participants will be back on the road in a short time. The Annual Vehicle Fire Inspection helps ensure that all fleet vehicles and equipped with adequate and working extinguishers and ensures that the University Fleet can operate safely and efficiently.

If you have any questions, please contact Patricia Pressley at Auburn University Risk Management and Safety.

Annual Vehicle Fire Extinguisher Inpsection

3/25/2019

On Wednesday April 24th, Auburn University Risk Management and Safety will hold their annual Vehicle Fire Extinguisher Inspection from 12pm until 4pm at the Facilities Vehicle Servicing Area. This event serves as an easy and convenient opportunity to have all University Fleet vehicles equipped with a Fire Extinguisher to have their existing units checked, tested, or even replaced.

The process is simple, and participants will be back on the road in a short time. The Annual Vehicle Fire Inspection helps ensure that all fleet vehicles and equipped with adequate and working extinguishers and ensures that the University Fleet can operate safely and efficiently.

If you have any questions, please contact Patricia Pressley at Auburn University Risk Management and Safety.

Creating a Safer Auburn: Managing Risks through Accident Reporting

3/25/2019

Risk Management and Safety will offer a unique HRD program entitled: Creating a Safer Auburn: Managing Risks through Accident Reporting on Wednesday March 27th at 2:30pm.

This informative and important course is designed for Auburn employees and will help foster a proactive safety culture for any department by helping you become an impactful safety ambassador for your unit.

Accidents can occur at Auburn University. Before they do, RMS wants you to have the best tools and resources to manage risk.

RMS will cover a broad range of informative topics related to Accident Reporting including an overview of the accident investigation process, awareness of the resources available to help you collect an effective report, and what to expect after an accident using key lessons learned from real-world experiences.

The offering number 19632 and course code RM140.

If you have any questions, please contact Auburn University Risk Management and Safety at aurms@auburn.edu

Campus Building Surveys

3/25/2019

Risk Management & Safety will be working with Duff and Phelps, LLC to survey properties insured by the State Insurance Fund. Representatives will be on campus from February 25, 2019 – March 1, 2019 to assess current condition and valuation of select buildings. You may notice the surveyors entering mechanical rooms, electrical closets, and other restricted areas; however, they will be accompanied by AU Facilities Management. Every effort will be made to schedule surveys at times that are convenient for building occupants.

Questions or concerns may be directed to Risk Management & Safety at 844-4533.

Parkerson Mill Cleanup

2/15/2019

Auburn University Risk Management & Safety (RMS), the City of Auburn, Auburn University Crop, Soils, and Environmental Sciences Club, and the Alpha Epsilon Honor Society will host a creek clean-up event on Saturday, February 23rd, from 1:30 pm until 4:00 pm along the banks of the campus’ Parkerson Mill Creek. Students, faculty, staff and those associated with the university community are invited to participate in the event.

A small stream that stretches past the football and baseball fields and the old coliseum on the campus, the Auburn University Parkerson Mill Creek was transformed in 2014 into an area used as outdoor classrooms for environmental research. It is up to the Auburn University community to keep this living stream vibrant, clean and beautiful.

Volunteers for the event should meet behind the intramural fieldhouse, next to the parking lot, at 1:00pm. Gloves and bags will be available for collecting, but participants will be responsible for bringing appropriate footwear, such as rubber boots or waders. Students will need to sign a Volunteer Release & Acknowledgement of Risk waiver prior to collecting; forms will be available the day of the event.

To register, please visit aub.ie/creek

For more information or to request a waiver, please contact Tom McCauley at mccautp@auburn.edu or Dusty Kimbrow at dkimbrow@auburnalabama.org

Campus Building Surveys to be conducted February 25 through March 1

2/15/2019

Risk Management & Safety will be working with Duff and Phelps, LLC to survey properties insured by the State Insurance Fund. Representatives will be on campus from February 25, 2019 – March 1, 2019 to assess current condition and valuation of select buildings. You may notice the surveyors entering mechanical rooms, electrical closets, and other restricted areas; however, they will be accompanied by AU Facilities Management. Every effort will be made to schedule surveys at times that are convenient for building occupants.

Questions or concerns may be directed to Risk Management & Safety at 844-4533.

Risk Management and Safety implements new 12 & 15-passenger van policy

1/29/2019

In response to new federal regulations that now require newer 12 and 15-passenger vans to have additional safety features like Electronic Stability Control and Tire Pressure Monitoring Systems, Risk Management & Safety has updated Auburn University’s 12 & 15-passenger van policy to allow for the purchase of vans model year 2012 and newer. The National Highway Traffic Safety Administration (NHTSA) recently stated that rollover is no longer a danger for newer 15-passenger vans due to the implementation of these new safety requirements.

Other highlights of the updated policy include:

- The requirement that the number of occupants must be less than eight (8) has been removed for vans that are model year 2012 and newer.

- Please note seat belts should be worn by all occupants at all times, so the number of occupants should never be more than the number of seat belts.

- For vans that are model year 2011 and older, the requirement that the number of occupants should be less than eight (8) remains in effect.

- Additionally, vans that are model year 2011 and older should not be driven distances greater than 25 miles from the point of origin nor should they be driven on interstate highways.

- In addition to the existing driver training requirements, there are new requirements for drivers of 12 & 15-passenger vans and mini-buses:

- Drivers must be age 21 or older (18 or older if driving is restricted to on-campus)

- Drivers must have a current motor vehicle record (MVR) within the past two years on file with Risk Management & Safety prior to operation

Departments will be responsible for providing Risk Management & Safety with a list of their van drivers so that MVR’s can be ordered and reviewed for approval.

A full copy of the updated policy can be found here.

ANNOUNCEMENT: Waste Pickup Changes for Holiday Break

12/5/2018

Auburn University Risk Management and Safety will adjust their normal waste pickup routines during the 2018 Auburn University Winter Break.

Both chemical and medical waste pickups will be suspended through the holiday period (December 20th – January 2nd).

Any chemical or medical waste generated during this period should be properly containerized, labeled, and stored per guidelines found on the Environmental Health and Safety page of the Auburn University Risk Management website ( http://aub.ie/waste ).

Chemical and medical waste pickups will resume on January 7, 2019 on an as requested basis.

Pathological waste pickup service will be provided throughout the holiday period on an as needed and requested basis. Pickup requests should be submitted through the AiM work management system ( https://aim.auburn.edu/aim ). To ensure the timely removal of pathological waste during this period, advance notice should be coordinated through Steven Nolen (334-703-3859) or Billy Cannon (334-703-0419).

If you anticipate the need for service over the Holiday break, please contact Tom McCauley, Environmental Program Manager, at 334-844-4870 so that Risk Management and Safety may best coordinate and accommodate your needs.

Parkerson Mill Creek Clean-up Event

11/20/2018

Auburn University Risk Management & Safety (RMS) and the City of Auburn will host a creek clean-up event on Tuesday, November 27, from 9 a.m. until Noon along the banks of the campus’ Parkerson Mill Creek. Students, faculty, staff and those associated with the university community are invited to participate in the event.

A small stream that stretches past the football and baseball fields and the old coliseum on the campus, the Auburn University Parkerson Mill Creek was transformed in 2014 into an area used as outdoor classrooms for environmental research. It is up to the Auburn University community to keep this living stream vibrant, clean and beautiful.

Volunteers for the event should meet behind the intramural fieldhouse, next to the parking lot, at 9 a.m. Gloves and bags will be available for collecting, but participants will be responsible for bringing appropriate footwear, such as rubber boots or waders. Students will need to sign a Volunteer Release & Acknowledgement of Risk waiver prior to collecting; forms will be available the day of the event.

For more information or to request a waiver, please contact Tom McCauley at mccautp@auburn.edu or Dusty Kimbrow at dkimbrow@auburnalabama.org

Campus Fire Safety Month 2018 is a success for RMS and Auburn

10/1/2018

With September ending, Auburn University Risk Management and Safety wrapped up another successful Campus Fire Safety Month. The month of September saw an increased push for fire awareness and campus readiness with activities, events, and signage throughout campus and the community.

The events kicked off with “Popcorn and Prevention”, where RMS Staff met students and handed out bags of microwave popcorn. The popcorn was labeled with cooking safety tips and was chosen because improperly cooked popcorn was one the leading cause of fire alarms going off. This simple example showed how even the smallest things should be noticed and remembered when it comes for fire safety.

RMS Staff members also brought a new activity to students, faculty, and staff: the FireSmarter Gameshow. The knowledge of basic fire safety tips was tested in a fun and interactive man-on-the-street game and after answering, students could spin the wheel for prizes and left a little fire smarter and fire safer.

Finally, Risk Management and Safety welcomed national renown speakers Sean Simons and Alvaro Llanos as they shared their personal and inspirational story of recovery, redemption, and hope after surviving a fatal campus fire at Seton Hall University. This intimate setting allowed for a personal communication and a better appreciation of this impactful and life-affirming message.

This year, Governor Kay Ivey acknowledged, recognized, and proclaimed September officially as Campus Fire Safety Month across Alabama. The Auburn University Student Government Association also recognized Campus Fire Safety Month and passed their own resolution to personally recognize and participate in the event.

“Campus Fire Safety Month,” was founded by the Center for Campus Fire Safety, and is a nationwide effort to raise fire and life safety awareness on college campuses throughout the month of September each year. According to the Center, August and September are historically the worst times of the year for fatal campus-related housing fires.

Auburn University Risk Management & Safety (RMS) has recognized officially recognized and support Campus Fire Safety Month for over three years. Through their participation, Risk Management and Safety hopes to bring understanding to our 25,000-plus student body (and eventually, the surrounding community) about the dangers of housing-related fires. Students need to be aware of how fire could touch their lives, that fires DO happen in campus-related settings, and that they should take steps to protect and educate themselves about fire safety, no matter their place of residence.

The 2018 edition of Campus Fire Safety Month at Auburn University was supported and sponsored by Auburn Bank, Belfor Restoration Johnson Controls, and Brendle Fire Equipment. Risk Management and Safety personally thanks these community partners and their commitment to keeping Auburn University safe.

For more information on Campus Fire Safety Month and to be a partner in 2019, please contact Kevin Ives at pki0002@auburn.edu or follow Risk Management and Safety on Twitter @AuburnRMS.

AURMS Presents Safety Training Sessions in August

8/10/2018

Auburn University Risk Management and Safety invites you to attend one of four Safety Training Sessions in August. These sessions will cover Laboratory Safety, Biological Safety, and Hazardous Waste Management and are a requirement for all laboratory personnel. The events will be August 22nd at 10:00 a.m., August 23rd at 3 p.m., August 24th at 10:00 a.m., and August 31st at 2:00 p.m. These informative training sessions will be presented by our experienced Safety Specialists, Officers, and Managers. The training sessions are free to attend and will be held at the Center for Advanced Science, Innovation, and Commerce (CASIC) Room 109. CASIC is located at 559 Devall Drive in Auburn at the Research Park.

Human Resource Development Class details Auburn Univeristy's OJI Program

6/13/2018

On Wednesday, June 13, Auburn University Risk Management and Safety held a Human Resource Development course on the On-the-Job Injury Program (OJI).

Risk Management Specialists Holly Leverette and Brooke Patton gave real world scenarios and statistics showing how critical proper claim reporting is and the frequency, severity, and type of claims that have been handled by Auburn University.

The majority of the presentation went over how to report an OJI Claim and explained the program in more detail. This will allow for future claims to be handled promptly and properly and will benefit all Auburn University student, faculty, and staff.

Auburn University is exempt from State of Alabama’s Worker’s Compensation laws (25-5-50); however, Auburn’s OJI Program provides financial assistance to injured employees where no other benefits exist. The program is a benefit, not insurance, and provides benefits only after all other applicable insurance coverage has been exhausted. The program’s goal is to help protect employees from financial hardship caused from on-the-job injuries or illnesses. Risk Management and Safety is responsible for administration of the OJI Program.

More information on the OJI program can found at Risk Management and Safety’s website. There you will be able to view today’s presentation, get step by step instructions, and most importantly, file a claim.

For more information on today’s presentation or Auburn’s OJI program, please contact Auburn University Risk Management and Safety at 334-844-2502 or online at auburn.edu/rms.

Now Available: New Online Claim Reporting Tool

2/7/2018

Accidents are difficult enough to get through, which is why filing incident/accident-related claims should not be… Unfortunately, despite advances in technology, few insurance companies today offer online filing options…

Accidents are difficult enough to get through, which is why filing incident/accident-related claims should not be… Unfortunately, despite advances in technology, few insurance companies today offer online filing options…

But at Auburn University, the process of reporting your campus-related claim just got a lot simpler thanks to the implementation of a new web-based claim reporting system, introduced by Auburn’s Risk Management & Safety (RMS). This new system eliminates the need for those reporting an accident/incident to have to contact the third party adjuster PMA Companies through a 1-800 phone number to file their claims.

From anywhere in the world, the Auburn University community can access the RMS website, and, with a simple click of a button, report their incident/accident. The new web-based reporting system streamlines the claim-reporting process, making it easier for the user and allowing for a quicker, more accurate turnaround time on the issue being reported. The new system puts control of claim reporting in the hands of those filing the claim. No phone calls, no waiting for the right time to make contact with a provider, and no hassles.

RMS Risk Management Specialist Brooke Patton said the new system was in the works for some time. “To better serve Auburn University and its community, our transition to this new system will streamline the way employees, students and visitors report accidents occurring on campus,” Patton said. “This system was in the works for the better part of a year, and we are excited to be able to offer this new tool to the Auburn community. Our hope is that the claims reporting process will be much easier for those needing to utilize it.”

Those submitting a claim through the new online system should be prepared with the appropriate information that will make their claim complete, such as the date of the injury/illness and location information for where the injury/illness occurred.

The new online claims-reporting tool is available on the Risk Management & Insurance section of the RMS website. For questions or comments, please contact Risk Management Specialist Brooke Patton at x4-6231.

Need to report a claim? Click here.

Parkerson Mill Creek cleanup lends evidence to importance of keeping campus streams litter-free

5/24/2017

“Out-of-sight, out-of-mind” – this might be the best way to describe parts of Parkerson Mill Creek, one of Auburn’s natural resources, hidden by brush, discreetly meandering past the soccer, baseball and football fields and the Intramural Fieldhouse on the Auburn campus. Of course, this might also be the best way to describe the numerous amounts of campus litter that finds a way into the creek, tucked away beneath rocks in the slow-moving water of the creek bed and underbrush on the muddy banks…

“Out-of-sight, out-of-mind” – this might be the best way to describe parts of Parkerson Mill Creek, one of Auburn’s natural resources, hidden by brush, discreetly meandering past the soccer, baseball and football fields and the Intramural Fieldhouse on the Auburn campus. Of course, this might also be the best way to describe the numerous amounts of campus litter that finds a way into the creek, tucked away beneath rocks in the slow-moving water of the creek bed and underbrush on the muddy banks…

Many of the university community walk past Parkerson Mill Creek on a daily basis, in a rush to get to one appointment or another, perhaps vaguely aware of its existence but unaware of the vital role it - and other small waterways just like it – plays in the sustainability of our precious drinking water resources.

This is the main reason Auburn University Risk Management & Safety’s Environmental Health and Safety Department annually hosts an on-campus cleanup of Parkerson Mill Creek for faculty, staff and students. RMS Environmental Health and Safety Technician Michael Freeman has been leading the event for almost 10 years now and has had a longtime passion for maintaining the earth’s water quality.

This year, less than 20 members of the campus community gathered on Tuesday, Feb. 28, and, wearing protective gloves and rubber boots, spent several hours filling more than eight sturdy garbage bags of litter gathered from Parkerson Mill. The clean-up area stretched from the Auburn Wellness Kitchen to the Jane B. Morrison Field. University units typically taking part in the cleanup include Navy ROTC., U.S. Coast Guard AUP, Alabama Water Watch, College of Agriculture, College of Engineering, Greek Life, Honors College, COSAM, Office of Sustainability and AU Facilities Management, among others.

“I just want to see more people on campus interested in this,” said Freeman, who was also a member of the U.S. Coast Guard and the U.S. Army. “Parkerson Mill Creek is listed as impaired by the Environmental Protection Agency (EPA) for pathogens and sediment load. I feel that it is our duty and obligation to not only clean up the creek, but to also make people aware of the litter that ends up in our waterways from poor management of solid waste.”

“Clean water is a vital component of life, and we must be better stewards of this most precious natural resource.”

Unknown to many, streams play a critical role in providing clean drinking water by ensuring a continuous flow of water to surface waters and by helping to recharge underground aquifers. According to the EPA, approximately 117 million people – one in three Americans – get drinking water from public systems that rely on these streams.

The Parkerson Mill Creek clean-up volunteers collected a number of interesting things from the banks and water that day, including orange and blue pom-poms with their ribbons embedded into the creek underbrush; sunglasses; a decorative eyeball; household cleaning instruments; Styrofoam; and a bale of rusty barbed wire.

Thomas Loxley, a Kentucky native and second-year Auburn graduate student in Biosystems Engineering, was among the volunteers and said, though he had helped with roadway clean-ups in the past, this was his first creek clean up. “I think this is a much bigger deal, and I wish more students would get involved,” Loxley said. “Litter in the water travels further and can have a greater negative impact. This is also a great way to give back to the campus.”

The next creek clean-up event will take place November 2017. For more information about Auburn University creek clean-ups, or to see how you can get involved, contact Michael Freeman at freemms@auburn.edu.

|

|

| ||

|

|  | |

| Thomas Loxley makes an odd find while gathering litter from Parkerson Mill Creek. | Volunteers included members of RMS, the Office of Sustainability, Facilities Management and Auburn students. |

Media Contact: Kati Burns, RMS Communications & Marketing Specialist | 334-844-2502 | klb0095@auburn.edu

Celebrating "Insurance Careers Month" - Meet Our RMS Staff

2/22/2017

Valentine’s and groundhogs, heart health and Superbowl Sundays – these are the things we most commonly associate with the month of February each year. However, since 2016, the insurance industry has been recognizing February for a special time all its own – Insurance Careers Month.

According to insuremypath.org, Insurance Careers Month is a cross-industry, multi-phased initiative designed to raise awareness of the dynamic career opportunities in the risk management and insurance profession, and to recruit the next generation of industry leaders. Unfortunately, many students and young professionals have no idea these careers even exist or, at best, they have a genuine misunderstanding of the risk management and insurance fields.

To help bring awareness to this lucrative field, throughout February, Auburn University Risk Management & Safety will highlight several of our dedicated Risk Management & Insurance (RMI) staff members, who will share their experiences and perspectives on a field that has shaped their lives, from the higher education RMI standpoint.

Participate in the national conversation about Insurance Careers Month by following #InsuranceCareersMonth and #CareerTrifecta on social media.

Meet Patrick White, Risk Management Specialist

White Finds Variety & Opportunities in Insurance Career

As an undergraduate student at the University of Georgia in the early 2000s, Patrick White was drawn to the Risk Management & Insurance field because of the vast array of opportunities available. From production to underwriting, to claims and loss control, among others, the field offered a wide variety of career options.

White has worked as a commercial account executive handling global accounts for an insurance group, and an account representative for State Farm, among others. He came to work in higher education in 2015 as an Auburn University Risk Management Specialist, a setting he finds particularly appealing.

“The risks inherent to higher education are very unique when compared to the commercial sector,” said White, who is currently pursuing a master’s in higher education administration. “I have enjoyed applying what I have learned over my years in the industry while at the same time learning how the higher education model differs from the commercial accounts I worked with in the past.”

Analytical by nature, White enjoys policy review, and providing counsel and advice on how to address risks facing Auburn University. His day-to-day job responsibilities consist of managing the university’s automobile self-insurance program; overseeing the administration of the University Fleet Policy; handling claims; collecting information from departments to provide to the university’s insurance companies; and reviewing contracts, among others.

“Insurance has opened many doors for me in my career,” White said. “It has also opened my eyes to many ways that risk management and insurance can affect the quality of life for so many individuals.”

Here’s what else he had to say about his experiences in the risk management and insurance industry thus far.

What would you say is the most difficult part of your job?

WHITE: The most difficult part of my job is that I have to be a professional at reacting to situations as they come my way. As a planner, I find it hard sometimes to switch gears from the comprehensive projects that I may be working on to deal with the pressing issues that can come through our office on any given day, such as claims or general questions regarding the risk implications of various activities across campus.

Do people misunderstand your industry? If so, in what ways and why do you think there is misunderstanding?

WHITE: Many people on the outside see us as the “no” people – trying to find ways to keep fun things from happening. However, we like to have fun, too. We just want people to be safe, and we want to make sure the university’s interests are protected, which benefits us all. Getting people to think about all the risks associated with any given activity can be challenging at times.

What is the biggest obstacle facing the insurance industry right now? How will you work to overcome it in your position?

WHITE: It has been widely documented that a mass exodus of insurance talent is imminent due to the aging work force. Coupled with the struggle to recruit new talent to the field, this will present somewhat of a crisis in the next decade. I work hard to promote our industry and encourage new talent to consider risk management and insurance as a career. Our department is hiring an undergraduate intern this summer for that very reason, and I play an integral role in the planning and administration of this exciting opportunity. Having completed an underwriting internship while an undergraduate, I appreciate the invaluable experience an internship can afford for someone looking to choose a career path.

What advice would you give to someone thinking of seeking a career in your industry?

WHITE: My advice would be to work in a customer-facing position in the early stages of your career. I always said I did not want to go into sales, but then I ended up working in insurance production for almost eight years before coming to Auburn. Having to put myself out there and learn how to market a product gave me a better understanding of how to market myself. Also, start early with securing industry credentials like CPCU or ARM. It only gets harder to complete those designations as you get older and take on more responsibility.

Meet Melissa Agresta, Auburn University Risk Manager

Former Art Student Finds Creativity in RMI

Auburn’s University Risk Manager Melissa Agresta began her career in risk management in a way that many people might not consider – working with art museums. The Virginia native and mom of three earned a bachelor of arts in studio art and art history from James Madison University; a master’s in risk management & insurance from Florida State University; and she is currently pursuing a doctorate of philosophy in adult education from Auburn University.

Auburn’s University Risk Manager Melissa Agresta began her career in risk management in a way that many people might not consider – working with art museums. The Virginia native and mom of three earned a bachelor of arts in studio art and art history from James Madison University; a master’s in risk management & insurance from Florida State University; and she is currently pursuing a doctorate of philosophy in adult education from Auburn University.

Agresta “happened upon” the insurance industry when she took a position right after undergraduate school working as a technical assistant and, later, vice president for specialty areas for private brokerage firm Willis Towers Watson in Arlington, Virginia. Her work focused on insurance and risk evaluation/development for some of the nation’s most prestigious art museums, galleries, dealers, collectors and universities. Many of her clients were risk managers for higher education institutions and, through their influence, she grew fond of the idea of working in risk management for a university.

Agresta began work at Auburn University in 2012 as a risk management specialist and moved into the role of university risk manager in 2015. She oversees four other risk management specialists and works diligently to ensure her department’s responsibilities align with the university’s mission. Not only does her team uncover new risks but they also advise the university on how to address them.

Did You Know: CNN Money chose “risk management director” as the No. 2 job in America, second only to “mobile app developer,” on its list of top 100 careers in 2017 with “big growth, great pay and satisfying work.”

In her spare time, Agresta still enjoys art and photography, but she has found the field of risk management and insurance does offer opportunities for those with creative minds. “It’s a field that requires the generation of new ideas and problem solving, something those with an artistic side thrive on,” Agresta said. “RMI is continually changing and offers many opportunities to make a difference. You could be risk manager for a diversity of organizations, ranging from anything such as a large manufacturing company or a city, to a national park or even an NFL team.”

Here is what else Agresta had to say about her more than 10-year journey into the risk management and insurance industry, and advice she has for young minds considering pursuing a career in RMI.

What are some of the differences in working in RMI somewhere else as opposed to higher education?

AGRESTA: After spending nine years working in the corporate world, I would say the biggest difference is the culture. In the corporate world, and especially a company with stockholders, there is always a preoccupation with profits and financial growth. It is competitive and fast-paced. Sweeping changes are sometimes implemented unexpectedly. In higher education, the focus is more on supporting a university’s mission, which is not making money, but serving the community and providing world-class education and research. Change is more gradual and, in general, the environment is supportive of employee professional development and less concerned with internal competition. That is not to say one is better than the other though, as they each offer unique perspectives. However, where one will be most satisfied will depend on your personal characteristics and goals.

What is the most difficult part of your job?

AGRESTA: The most difficult part of the job is effectively communicating what RMI does and why it is important, so that others understand we are trying to help. In order to be a good risk manager, you have to build credibility and relationships with a wide variety of people. If you are not successful at this, then you will not be able to effect positive change and promote a healthy risk culture in your organization.

Why do you think people misunderstand what RMI is and what it does?

AGRESTA: Society tends to have a negative view of the insurance industry as a whole. Words like “boring,” “unfair,” or “greedy” come to mind. What people misunderstand is that insurance is the financial backing allowing businesses to prosper without the worry of financial ruin. It is a basic building block of a sound economy.

How has your career in risk management and insurance changed/defined your life?

AGRESTA: My insurance career has spanned different organizations, as well as, having given me the opportunity to be on both the sales side and the client side. Through my work, I have had the opportunity to visit Lloyds of London where I learned the history of the industry and how it ties into the greater economy. By being in an academic environment, I have been inspired to become a lifelong learner. I have had the pleasure of working with people from all different types of backgrounds, such as wealthy art collectors, academics and fellow administrative staff here at Auburn. I have gotten to witness first-hand the problems facing our society and the solutions people are always creating. I feel that it has helped me become a well-rounded individual, one who has learned how to communicate and relate to many different people.

What advice would you give to someone thinking of seeking a career in your industry?

AGRESTA: I think the risk and insurance industry is an exciting field that offers many opportunities for success. For anyone wanting to enter the industry, I recommend a few things. First, tailor your education. Many institutions offer degrees with a focus on risk management & insurance. Additionally, obtaining insurance industry designations such as the CPCU, ARM or CRM, which will add to your credibility and knowledge, and really give you an advantage over other candidates. Second, make industry connections and develop relationships. Find a good mentor. Third, try to get relevant experience as soon as possible. Internships and/or apprenticeships are a great opportunity. Consider taking jobs that are entry level and not necessarily your dream job, but a stepping-stone. Last, do not be afraid to keep your opportunities open geographically, if possible, otherwise you will be severely limiting your potential.